ifrs16-the-perfect-experience-of-lease-accounting

IFRS16: The perfect experience of lease accounting

What is IFRS 16?

The lease standard IFRS 16 newly issued by the International Accounting Standards Board (IASB) cancels the classification of finance lease and operating lease in IAS 17 lessee accounting, and adopts a single lease accounting model. Contracts classified as operating leases under the original standard will use an accounting method similar to the original finance lease. IFRS 16 significantly changes the relationship between businesses and their leases and is one of the most widespread standard changes in recent years.

What industries does IFRS 16 apply to?

Under the new standards, many industries will be affected. Among them, the impact on retail, transportation, aviation, banking and other industries is the most significant

How will the new standards affect corporate financial statements and indicators?

IFRS 16 Changes will be made to the company's balance sheet, profit and loss statement, and cash flow statement, and commonly used financial indicators will also change, affecting the company's "purchase or lease" business decision.

What industries does IFRS 16 apply to?

Under the new standards, many industries will be affected. Among them, the impact on retail, transportation, aviation, banking and other industries is the most significant

How will the new standards affect corporate financial statements and indicators?

IFRS 16 Changes will be made to the company's balance sheet, profit and loss statement, and cash flow statement, and commonly used financial indicators will also change, affecting the company's "purchase or lease" business decision.

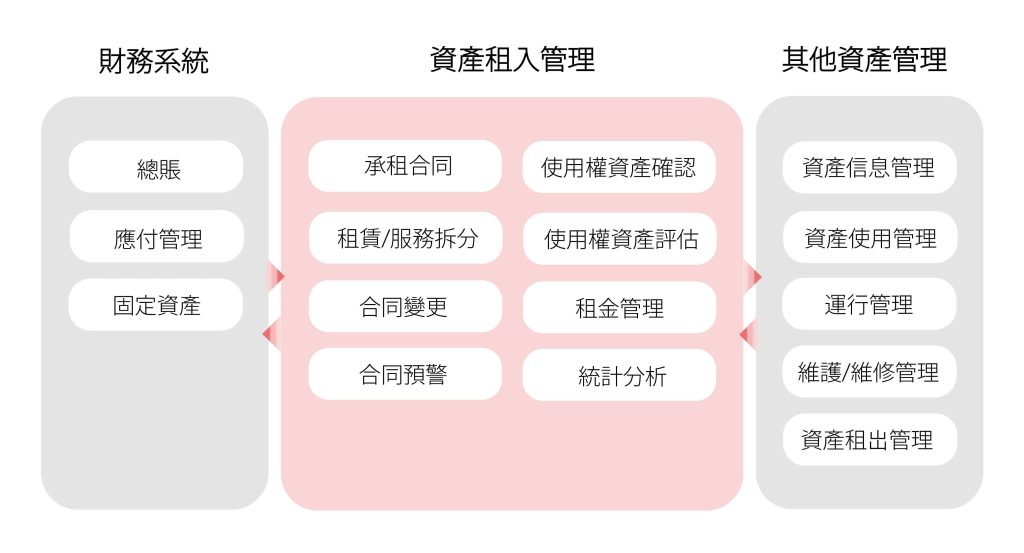

Brief description of IFRS 16 solution functions

The new standard needs to gather a lot of information that was not in the financial reporting system in the past. Therefore, companies need to update the existing system to collect lease-related information. UFIDA's IFRS 16 solution is connected to finance, asset leasing and fixed asset management systems, allowing enterprises to manage leasing business more effectively.

Support three major leasing scenarios

The contract specifies the lease object, lease cycle and payment rules, and makes fixed payment rent payments.

For real estate leases such as real estate, shops, garages, etc., the payment amount is not affected by variable factors

The contract specifies that the payment amount depends on sales indicators or asset usage, such as workload records, leased asset return locations, enterprise sales volume, etc., and variable rent payments are made.

If a store is leased (according to sales), the annual lease payment is X% of the store's income

The contract stipulates the type of assets leased, the rent standard, the lease calculation method and other framework agreements. The details of the specific leased assets and the lease cycle are confirmed by the lease.

Commonly used for equipment leasing, such as cars, photocopiers and computers

Program Features

mock trial calculation

report analysis

Rent and Discount Calculation

Full Profile and Card Information

Third-party system form docking

mock trial calculation

report analysis

Rent and Discount Calculation

Full Profile and Card Information

Third-party system form docking

Clients

800+ financial institutions choose UFIDA financial solutions

Resources

Explore Your New Way of Working

Tell us what you're working to improve

Speak with sales at (853) 2878 7375, or send your enquiry to marketing@yonyou.com.mo (853) 2878 7375 or email to marketing@yonyou.com.mo Contact sales