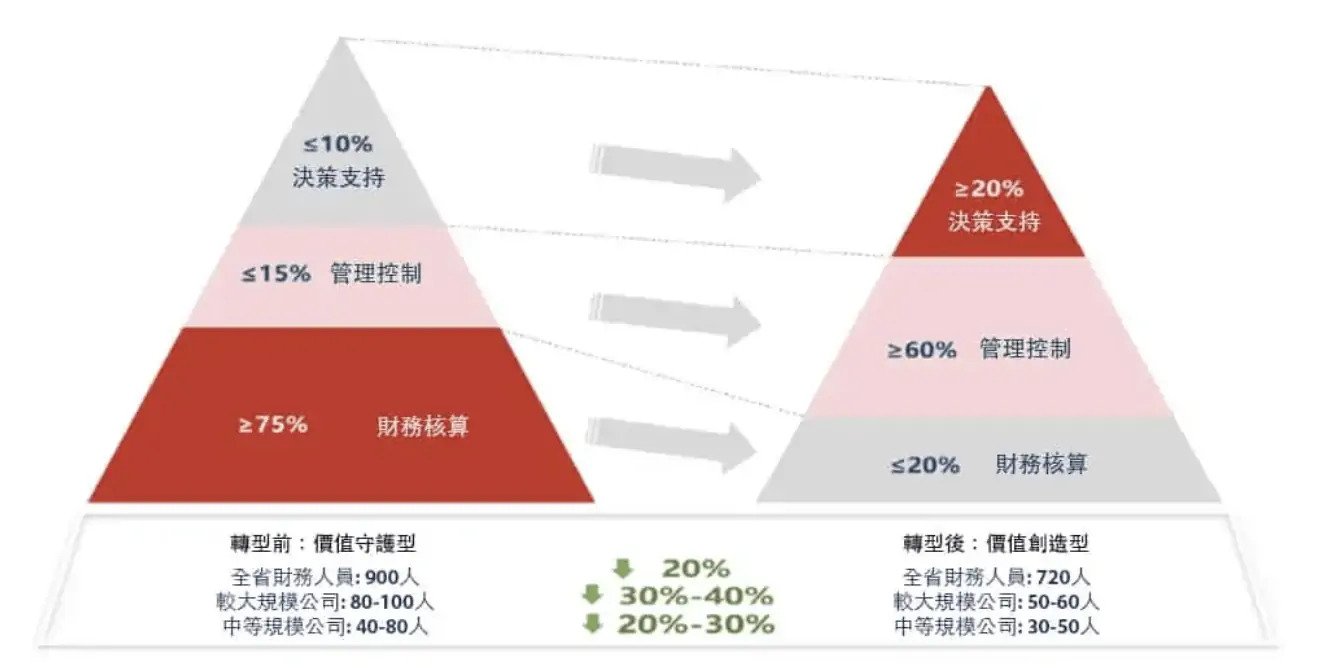

The demand for enterprise financial intelligence is increasing day by day.

The financial field of large enterprises has been faced with a lot of repetitive and boring work for a long time. Financial personnel have become "number checkers" and often need to spend a lot of time checking and querying data. Once a mistake is made, it will not only increase the workload, but also cause financial risks and losses to the enterprise.

the problem we are facing

- Pain point 1: To inquire about receipts and download details, you need to log in to multiple online banking interfaces and frequently switch between USB shields.

- Pain point 2: Manual supplementary recording of transactions, manual reconciliation one by one, manual matching of a large number of receipts one by one, there may be repeated reconciliation under multi-party channels, the efficiency is extremely low and the data cannot be traced.

- Pain point 3: Operations are all manual offline, information cannot be summarized in time, and leaders cannot grasp the whole picture of the group's funds in time.

- Pain point 4: There are a lot of paper documents, the cost of binding is high, and it is difficult to find them afterwards.

Convenient receipt acquisition, accurate data association, efficient automatic reconciliation and accounting entry are just needs of every enterprise.

Yinchuangtong can realize automatic acquisition of bank balance records, automatic association with financial systems, automatic account reconciliation, automatic write-off, automatic completion of the matching of collection slips, electronic receipts, and financial vouchers, and automatic completion of electronic file archiving.

Bank account connects the last mile of smart finance. Through RPA+AI technology, it can obtain balances, receipts, details, statements, etc., and realize full-process automatic collection, instant cleaning, intelligent adaptation, automatic association, automatic account reconciliation, risk monitoring and other multi-scenario applications.

At present, more than 1,000 customer companies have chosen Yinacantong.

Reason 1 for choosing Bank Account

intelligent! Realize automatic association, reconciliation, and write-off

RPA+AI automatically collects and analyzes to realize unmanned and paperless automatic operation of the whole process. It collects electronic receipts from domestic and foreign banks through direct and indirect bank connections. The collection range is wide, efficient, and safe.

Reason 2 to choose Bank Account

Accurate! High accuracy and high success rate

According to calculations, Yinactong has achieved an accuracy rate of 100% for automatic data collection, a success rate of 100% for automatic association, and a success rate for automatic account reconciliation.

Reason 3 to choose Bank Account

wide range! One-click access to thousands of banks

One-point access to thousands of mainstream banks, fully adapt to various ERP, OA and other scenarios, realize intelligent adaptation, real-time routing, and various versions can be updated immediately and seamlessly.

Four Reasons to Choose Bank Account

comprehensive! Full lifecycle management of electronic archives

Realize the full life cycle management of receipts, facilitate financial personnel to read, view, apply, hand over, destroy and other multi-process operations and applications, and accelerate the realization of digital and intelligent transformation.

Yinkantong bank statement processing solution

First of all, Yinzhangtong completes the acquisition of balance records and electronic receipts, and for banks that have completed direct bank-enterprise connections, they will automatically obtain them through the bank-enterprise direct connection interface. For banks that have not achieved direct bank-enterprise connection, it is obtained through RPA or an open banking interface. Among them, the intelligent RPA robot imitates human operations, automatically opens the webpage, logs in to the online banking, and finds the corresponding location to download the balance statement and electronic receipt. For abnormal funds (delayed payment processing by the bank, etc.), a secondary verification will be performed in time to check and match, and finally the files that have been successfully matched will be archived and managed in a unified manner.

After completing the information collection, Yintongtong will automatically associate the balance details and electronic receipt data obtained from the bank with the business documents and receipt and payment vouchers, and realize automatic reconciliation and automatic write-off through the form of bank reconciliation codes, as well as the matching of payment slips, electronic receipts, and financial vouchers.

The deployment of Yinkongtong is fast and convenient, the implementation period is short, and there is no need to make too many changes to the original financial process. The standardization of RPA operation and the reliability of system execution also ensure the timeliness and compliance of bank flow download matching. Through "digital employees", let the corporate finance move towards a new journey of comprehensiveness, integration, service-oriented, scenario-based and platform-based.